accumulated earnings tax calculation example

Accumulated earnings and profits are less than the. For example lets assume a certain company has 100000 in accumulated.

What Are Earnings After Tax Bdc Ca

Breaking Down Accumulated Earnings Tax.

. Calculating the Accumulated Earnings Tax. Assuming Company XYZ paid no dividends during this time XYZs accumulated earnings are the sum of its net income since inception. For example if a companys machinery has a 5-year life and is only valued.

The company made a net profit of 700000 and paid 300000 in dividends in the same year. Let us consider the example of company A that bought a piece of equipment that is worth 100000 and has a useful life of 5 years. RE initial retained earning dividends on net profits.

The minimum accumulated earnings credit allowable is 25000000. Accumulated EP on January. The value is part of a businesss balance sheet - more specifically its listed under the shareholders equity division.

A computation of earnings and profits for the tax year see the example of a filled-in worksheet and a blank worksheet below. 1000000 - EP depreciation 500000 - Federal income taxes paid 1500000 - Interest paid but not deducted 2500000 - 50 of meals. Multiply each 4000 distribution by the 0625 figured in 1 to get the amount 2500 of each distribution treated as a distribution of current year earnings and profits.

The dividends paid to shareholders of preferred and common stocks amount to 2725 million. Accumulated Earnings Tax can be reduced by reducing Accumulated Taxable Income. Up to 10 cash back 21.

When the net profits of a company increase the accumulated earnings also increase. Accumulated profit also known as retained earnings is the cash that remains after companies distribute dividends to their shareholders. Therefore the undistributed profits of company ABC for the fiscal year 2015 are 60 billion 2725 million 57 billion.

Calculating the Accumulated Earnings RE Initial RE net income dividends. The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis-courage the use of a corporate umbrella for personal income. The accumulated earnings credit allowable under section 535 c 1 on the basis of the reasonable needs of the business is determined to be only 20000.

10000 5000 - 5000 1000 - 3000 8000. X has been a profitable. This is because the accumulated earnings tax is directed at regular corporations who hold an excess of retained earnings instead of being distributed as dividends to shareholders.

Adjustments to this calculation or other methods may be appropriate. Calculation of EP. It required the parties to compute the new tax liability based on the corporations holdings under the courts rule 155.

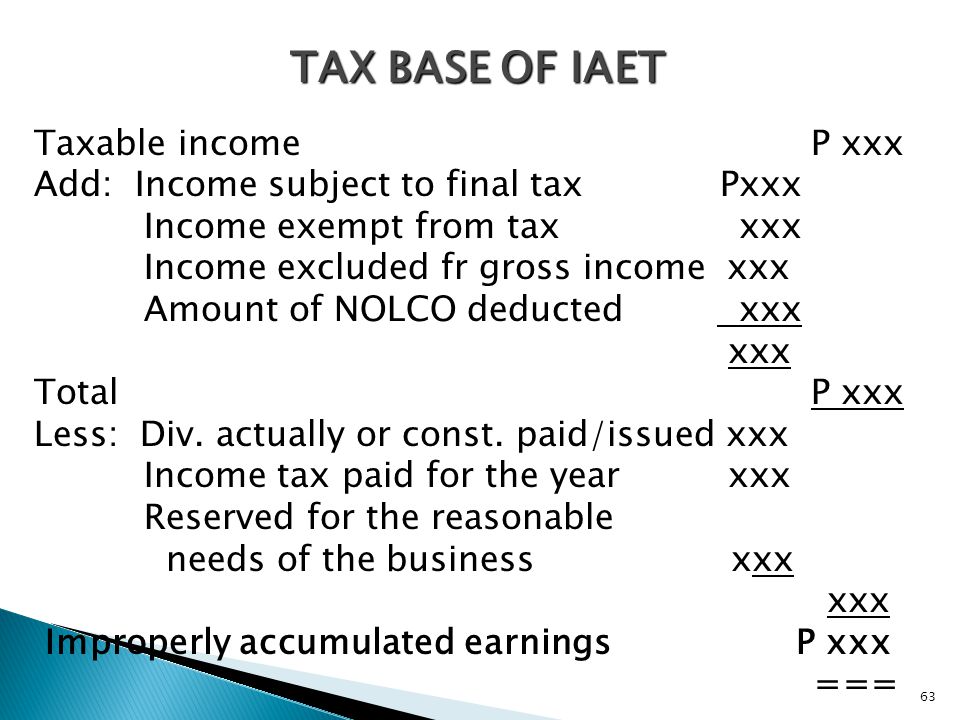

This amount of accumulated earnings can be used to lower the long-term debt or to launch a new product. The Accumulated Earnings Tax is computed by multiplying the Accumulated Taxable Income IRC Section 535 by 20. It compensates for taxes which cannot be levied on dividends.

Calculation of Accumulated Earnings. The formula for computing retained earnings RE is. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company.

The base for the accumulated earnings penalty is accumulated taxable income. This tax evolved as shareholders began electing to have companies retain earnings rather than pay them out as dividends in an effort to avoid. IRC Section 535c1 provides that.

Next a corporation should determine how it will use any earnings accumulated in excess of its working capital needs. When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders. However since the amount by which 150000 exceeds the accumulated earnings and profits at the close of the preceding taxable year is more than 20000 the minimum accumulated earnings.

535 c 2 A. Accumulated earnings and profits EP is an accounting term applicable to stockholders of corporations. The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed.

The threshold is 25000 without accumulated earning tax. Retained earnings are the amount of a companys net income that is left over after it has paid dividends to investors or other distributions. The rate for the accumulated earnings tax is the same as the rate individual taxpayers pay on dividends or 20.

22500000 Tax depreciation. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income. The company pays the.

For example suppose a certain company has 100000 in retained earnings at the beginning of the year. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the. The result is 0625.

If the corporation was required to complete Schedule M-1 Form 1120 or Schedule M-3 Form 1120 for the tax year also attach. If there is a surplus of retained earnings a business may choose to use this money toward causes that will support its growth. In the case of a corporation the principal function of which is the performance of services in the field of health law engineering architecture accounting actuarial science performing arts or consulting the minimum accumulated earnings credit allowable is.

In this guide well be explaining its importance how to calculate it and. Since corporation taxes are lower than high-bracket. The umbrella principle is simple.

Divide the current year earnings and profits 10000 by the total amount of distributions made during the year 16000. There is a certain level in which the number of earnings of C corporations can get. The equipment is not expected to have any salvage value Salvage Value Salvage value or scrap value is the estimated value of an asset after its useful life is over.

This leftover amount is what the company retains. The accumulated earnings tax is considered a penalty tax to those C corporations that have accumulated over 250000 in earnings 150000 for PSC corporations and if that excess amount has not been distributed to shareholders in the form of a dividend. The parties disagreed on the correct tax computation and instituted the current case to determine the right amount.

For example the receipt of a 100 portfolio dividend would be reflected in taxable income only to the extent of 30 100 dividend income less a 70 dividends-received deduction but EP must be increased by the 70 dividends-received deduction amount to accurately reflect that the company has a full 100 economic accession to wealth. Accumulated earnings and profits are a companys net profits after paying dividends to the.

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

What Are Retained Earnings Bdc Ca

What Are Accumulated Earnings Definition Meaning Example

Determining The Taxability Of S Corporation Distributions Part Ii

Demystifying Irc Section 965 Math The Cpa Journal

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

Determining The Taxability Of S Corporation Distributions Part I

Determining The Taxability Of S Corporation Distributions Part Ii

Earnings And Profits Computation Case Study

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)